African Bank Insurance Claim Procedure : africanbank.co.za

Organization : African Bank Limited

Facility : Insurance Claim Procedure

Website : https://www.africanbank.co.za/en/home/product-credit-life/

| Want to comment on this post? Go to bottom of this page. |

|---|

African Bank Insurance Claim Procedure

** The application for insurance made by the Main Member in respect of the Assured Life (lives) named in the Policy Schedule has been accepted by Guardrisk, subject to the terms and conditions set out herein, which constitutes the policy agreement in respect of the African Bank

Related : African Bank Connect Online Service : www.southafricain.com/10505.html

Credit Life Insurance

** Credit Life Insurance means that your debt is taken care of should anything happen to you. Make sure your debt is covered.

Not covered

** Self-employed and pensioners are covered only for death and disability on Loan and Credit Card debt.

** Any Credit Card transactions made after the date of an insurable event, are not covered.

Retrenchment, short time and compulsory unpaid leave are not covered for the first 90 days after your Policy has been opened, or in cases where:

** You were aware of your retrenchment before you opened the Policy

** You take voluntary retrenchment

** You resign or retire

** You are involved in strikes or lock-outs

** You voluntarily forfeit your salary

** You are dismissed because of misconduct, dishonesty or fraud

We don’t cover death or disability resulting from :

** Pre-existing medical conditions that you knew about 12 months before you opened your Policy

** Willful, self-inflicted injury or suicide

** Use of nuclear, biological or chemical weapons

** Participation in crime

** Hazardous activities like warlike operations, rebellion or revolution

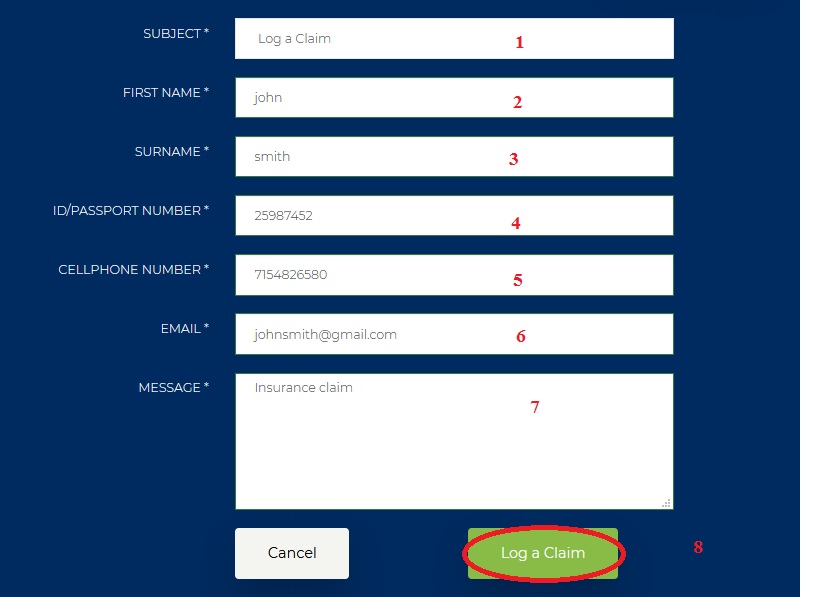

How To Submit Claim

Steps :

Kindly follow the below steps to complete the claim form. Go to the official website,click on submit claim button.

Step 1 : Select your Subject *

Step 2 : Enter Your First Name *

Step 3 : Enter Your Surname *

Step 4 : Enter Your ID/Passport Number *

Step 5 : Enter Your Cellphone Number *

Step 6 : Enter Your Email *

Step 7 : Enter Your Message *

Step 8 : Click on log a claim button.

Funeral Insurance

** The last thing you want your loved ones to worry about should anything happen to you, is how to pay for your funeral.

** Our Funeral Insurance gives you peace of mind.

What documents you need when you claim?

** Claiming for Funeral Insurance is quick and easy.

** Make sure you have these documents on hand when you claim

** Complete and submit online, or print out, complete and email or fax to us

** Certified copy of the main member’s South African Identity Document

** Certified copy of the beneficiary’s South African Identity Document (if not the main member)

** Copy of the beneficiary’s most recent bank statement

** Certified copy of the deceased’s South African Identity Document (or birth certificate for minors)

** Certified copy of the deceased’s death certificate

How to Submit a Claim?

Steps :

Please kindly do follow the below steps to submit a claim. Go to the official website click on the submit claim button on home page.

Step 1 : Select your Subject *

Step 2 : Enter Your First Name *

Step 3 : Enter Your Surname *

Step 4 : Enter Your ID/Passport Number *

Step 5 : Enter Your Cellphone Number *

Step 6 : Enter Your Email *

Step 7 : Enter Your Message *

Step 8 : Click on log a claim button.

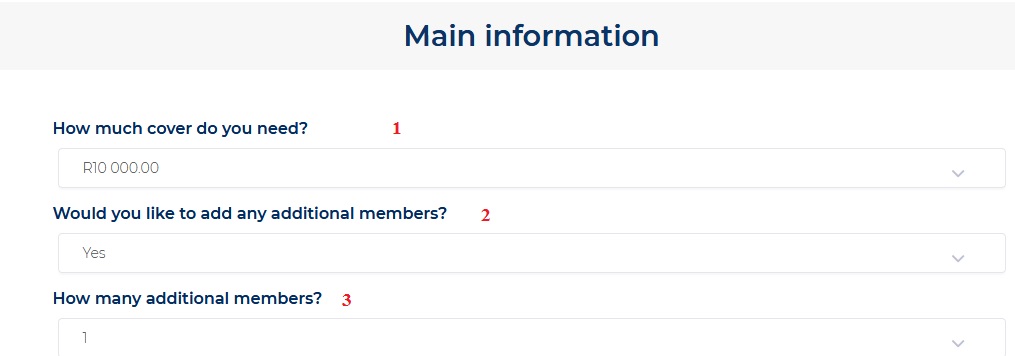

Premiums Calculator

Choose the kind of cover you want to calculate how much your premiums could be*

Categories :

1. Yourself

2. Yourself & Spouse

3. Yourself & UPTO 8 Children

4. Yourself & Spouse & UPTO 8 Children

How To Calculate

Step 1 : Select How much cover do you need?

Step 2 : Select Would you like to add any additional members?

Step 3 : Select How many additional members?

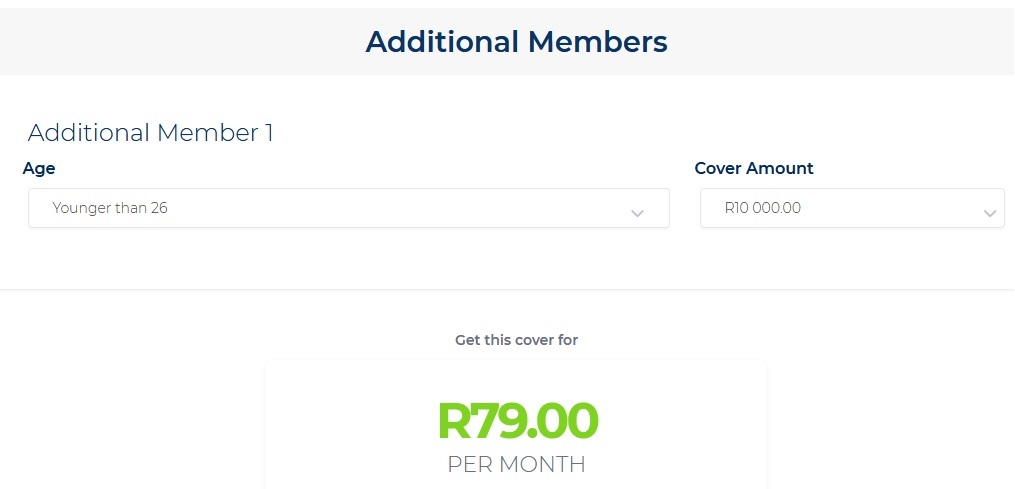

Additional Members :

Step 4 : Select Additional Member 1

Step 5 : Select Age

Step 6 : Select Cover Amount

Step 7 : Get this cover for R79.00 Per Month

Funeral Cover product comparison

How do you claim for Benefits?

** Claims must be reported within 6 (six) months after the death of any Policy Member in the manner as prescribed herein.

** Guardrisk shall pay out the claims within 24 (twenty four) hours of approval of a claim for Benefits – provided all requisite documentation as specified herein is received to the satisfaction of Guardrisk.

** Guardrisk retains the right to investigate claims for Extended Family Members for a longer period and will pay such Benefits within a reasonable period after approval of such a claim.

The following documentation has to be provided to Guardrisk when submitting a claim:

** Completed official claim form (available at any African Bank branch or on the African Bank website .africanbank.co.za);

** Certified copy of deceased Policy Member’s South African identity document (or birth certificate in the case of Children or Guardian Children);

Certified copy of the Main Member’s South African identity document;

** Certified copy of deceased Policy Member’s death certificate;

** The DHA1663;

** Certified copy of the Beneficiary’s South African identity document;

** Copy of the Beneficiary’s bank statement; and

** Any such other documentary proof as may be required by Guardrisk in its sole discretion.

FAQ On African Bank

Frequently Asked Questions FAQ On African Bank

Q: What is African Bank?

A: African Bank is a South African retail bank that offers a range of financial products and services to individuals, including personal loans, savings accounts, and insurance products.

Q: When was African Bank established?

A: African Bank was established in 2014, after the original African Bank Limited was placed under curatorship.

Q: What financial products and services does African Bank offer?

A: African Bank offers a range of financial products and services to individuals, including personal loans, savings accounts, and insurance products.

Q: How can I apply for a personal loan from African Bank?

A: You can apply for a personal loan from African Bank online, through the bank’s mobile app, or by visiting a branch. You will need to provide proof of your income, expenses, and banking history.