Capitec Bank Credit Enquiries & Your Credit Score Online : capitecbank.co.za

Name of the Organisation : Capitec Bank Limited

Type of Facility : Credit Enquiries & Your Credit Score

Headquarters : Western Cape

Website : https://www.capitecbank.co.za/bankbetterlivebetter/articles/how-credit-enquiries-affect-your-credit-score

| Want to comment on this post? Go to bottom of this page. |

|---|

What is Capitec Bank Your Credit Score?

Your credit score is available to companies and financial institutions, and makes it easier for you to obtain credit in the future.Some credit enquiries can affect your credit score.Find out how with Capitec Bank. By saving for a deposit, budgeting carefully and using credit responsibly, her dream became a reality

Related / Similar Facility : Capitec Bank Account Opening

How To Get Capitec Bank Credit Estimate Online?

Steps:

Kindly follow the below steps to get Capitec Bank Credit Estimate online

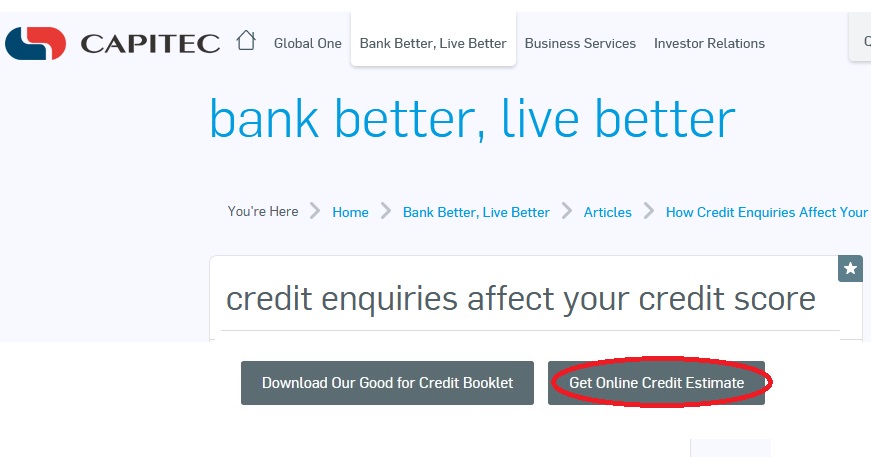

Step 1 : Go to the official website click on get Online Credit Estimate button

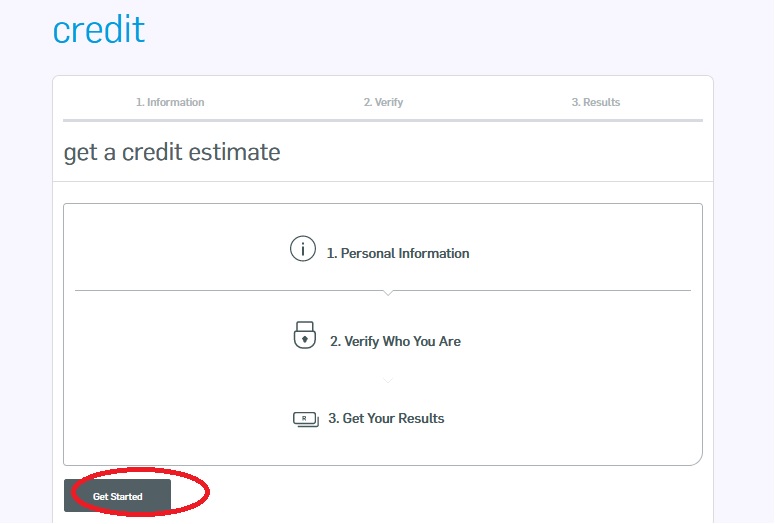

Step 2 : Next page will be displayed,click on the Get Started button.

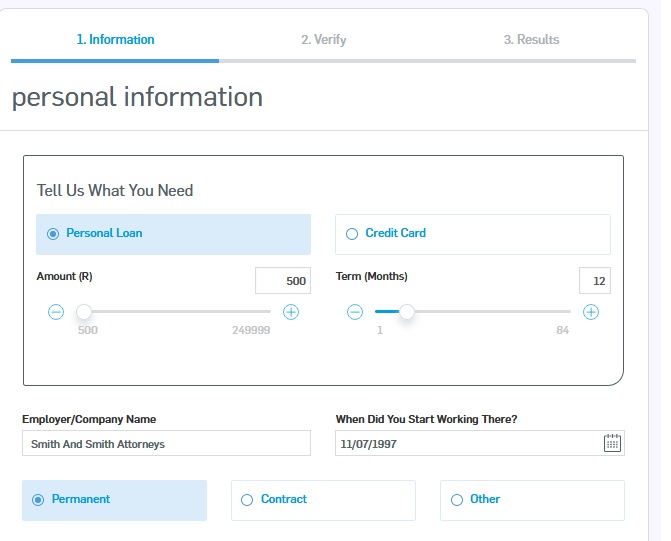

Step 3 : Enter Personal Information,Verify Details and get Results option button to get your credit score.

Capitec Bank Credit Profile Versus Credit Score

** Your Capitec Bank credit profile is kept on record by a credit reporting company, called a credit bureau.

** It contains information that is reported and updated by companies who have given you credit.

** When you apply for credit, such as a new credit card, the financial institution or lender will ask for your credit profile from the credit bureau.

** In addition to looking at your credit profile, many lenders use a credit score to determine whether you will repay your loan.

** Lenders have been using credit scores as part of the lending-decision process for over 20 years, and a higher credit score will improve your chances of being approved for the financial products you want, at the best terms and interest rates.

** Your Capitec Bank credit score changes based on several factors, such as when you pay your bills and how many loans you have.

** For example, if you pay your bills on time, your payment history will reflect your good payment habits, boosting your credit score.

Capitec Bank Soft Enquiries Versus Hard Enquiries

** Whenever information on your credit profile is requested, it’s called an enquiry and gets categorised as either a soft or a hard enquiry.

Soft Enquiries

** Capitec Bank Soft enquiries typically happen when a person or company checks your credit profile as part of a background check.

** This does not affect your credit score. Soft enquiries may occur without you even knowing and can be done without your permission.

** For example, a soft enquiry could come from a credit card company that pre-approves you for a card offer.

** Other reasons for a soft enquiry may include a credit and criminal check by a potential employer, or from an insurance company.

** Checking your own credit report is also a soft enquiry.

Hard Enquiries

** Capitec Bank Hard enquiries mainly occur when a financial institution checks your credit report when making a lending decision.

** This takes place when you apply for a loan, credit card or home loan.

** A hard enquiry can only take place with your authorisation.

** It’s important to know that hard inquiries might lower your credit score, and they can remain on your credit profile for 2 years.

** A hard enquiry can damage your credit score if you apply for credit too many times in a short time-frame.

** This indicates to the lender that you may be applying for credit you can’t afford, or someone could be attempting fraud.

** However, the exception is if you’re shopping for the best rates on a specific loan, such as a home loan or motor vehicle finance.

Note :

** Check your own credit score. You can request one free credit report per year from a credit bureau

** Before applying for credit take measures to build your credit score and history

** Switch to debit orders to ensure that your bills are always paid on time

** Limit your hard enquiries to one or 2 a year

Features of Capitec Bank

Capitec Bank is a South African retail bank that offers a range of financial products and services to individuals and businesses. Some of the features of Capitec Bank include:

Simplified Banking:

Capitec Bank offers simplified banking with easy-to-understand products and fees, making it easier for customers to manage their finances.

Low Fees:

Capitec Bank has low banking fees compared to other banks in South Africa, making it an affordable option for many customers.

High Interest Rates:

Capitec Bank offers high interest rates on savings and investment accounts, providing customers with the opportunity to earn more on their money.

help with handover loan please

can you please help with my handover loan to clear I paid up long ago

I feel like the Capitec credit score check is in accurate, I’ve tried to apply for a credit card and my request was declined they said I don’t meet Capitec banking criteria by I’m a Capitec banker and even my business account is from Capitec,I was then suggested to communicate with credit bureaus they told me that I’ve been blacklisted by home choice but I paid my home choice account and closed it 2 years back fine. I sent them the paid up letter but it’s been 2 months but Capitec doesn’t even give me an estimate… I am considering leaving the bank but it’s not so easy since I’m using their speed points on my shops and staff but I bet if buy next month things will still be like this. I will definitely leave it as I will be at Nedbank today to open a business account there and see how it works

Are you interested in getting a business or personal loan at 3% interest rate?

Matuludi and my account 540547009