uifecc.labour.gov.za : UIF COVID-19 TERS Application Procedure

Organization : South African Department of Labour (www.labour.gov.za)

Facility Name : UIF COVID-19 TERS Application Procedure

Applicable For : All Employers

Website : https://uifecc.labour.gov.za/covid19/covid19Regsitration

| Want to comment on this post? Go to bottom of this page. |

|---|

How To Apply For UIF COVID-19 TERS?

To Apply For UIF COVID-19 TERS, Follow the below procedure / steps

Related / Similar Service :

UIFECC TERS Application Bank Verification

Step 1:Type url https://uifecc.labour.gov.za/covid19/covid19 on any web browsers (e.g. internet explorer, chrome, firefox, etc.)

Step 2:UIF COVID –19 TERS National Disaster Application System Home Page

Step 3: Selection of Registration of UserClick on Register button to register as the user.https:uifecc.labour.gov.za/covid19

Step 4: Registration of User:Please populate all the fields on the screen below

Step 6: User Registration as Employer/Company Select registration as the “Employer/Company” or “Bargaining Council/ Council” After clicking on Proceed button: successfully registered as the user screen will pop up Select Proceed button to submit/create user profile Message notification that you have successfully registered as the user

Step 7: Login Screen Capture the following fields:Username: UIF reference number Password: newly created password Click Login button to proceed to the registration of the Company and Employees

Step 8:Registration of Employer Capture all the outstanding fields on the screen and click Proceed button. The system is prepopulate the following fields: UIF Reference Number, Trade Name, and Contact Number.Click Proceed button after capturing all the information on the Employer screen.

Note:After submitting your application you need to log back into your profile after a couple of days to check the status of your application. Please note that if you have captured your employees manually (rather than uploading a CSV) your application will be updated faster.

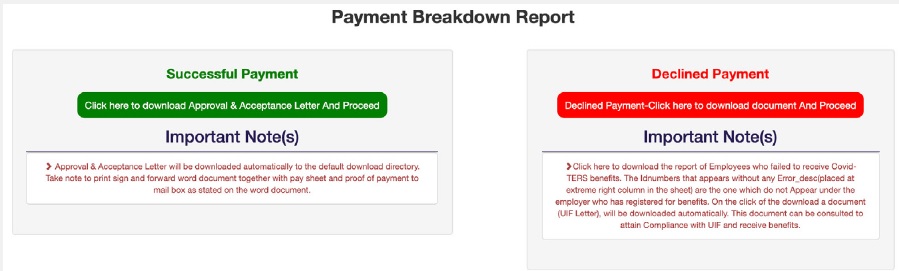

How To Get A Payment Breakdown Report?

Steps :

Step 1 : After check your Payment Status, Click PAYMENT BREAKDOWN REPORT in the menu bar

Step 2 : Click the green Successful Payment button and you will automatically download a letter that you need to sign and send to covid19UIFemployerpaymentreturns [AT] labour.gov.za with proof that you have distributed the funds to your employees.

** After you have clicked the button you will be able to see the list of employees that have been paid and how much has been allocated to each employee

** Click the EXCEL button to download this list.

Step 3 : Click the red Declined Payment button and a list of your staff who have been declined payment will come up onto the screen.

** Click the EXCEL button to download this list.

** Reasons for rejection will include,

1. “Employee not declared by the Employer” – you need to go to https://ufiling.labour.gov.za/uif/ and declare these employees (if you have been paying your UIF contributions).

2. “Application Not Processed yet” – you need to wait as payment should be made in a few days

3. “Failed Branch Code Validation” – you need to go to your profile and update your branch code on your profile to the universal branch code for your branch.

4. “Failed Account Verification” – your bank account details have failed verification.

Go back and edit them on the Covid-19 Portal plus email the bank confirmation letter and 3 months worth of bank statements to nombulelo.tshabalala [AT] labour.gov.za EMAIL SUBJECT: Your UIF Reference Number + Bank Confirmation (for e.g. 1234567/8 Bank Confirmation)

5. “Registered after the 15th of March” – this means that the employer only started paying their UIF benefits after March and this means that they are not eligible for the Covid19 TERS benefit.

How Do I Repay the UIF?

If one of the following happens and you need to repay the UIF

1. You received the wrong amount

2. Some of the your workforce have come back to work since your claim, and you’ve paid all or a portion of their salary to them.

3. You applied for the wrong people

In these instances you can make payment:

Unemployment Insurance Fund

FNB

Current Account

Account Number: 51420056925

Branch code: 23-31-45

Reference: C+UIF reference number

(eg. C1234567/7 )

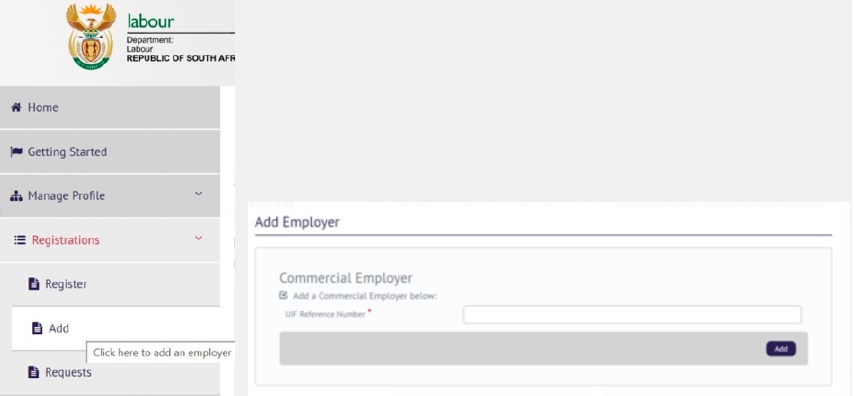

Declaration of Employees on UFiling

Steps :

Step 1 : Go to https://ufiling.labour.gov.za/uif/

Step 2 : Log-in or register if you have not done so before (you need to be the company owner)

Step 3 : Add your company to your profile

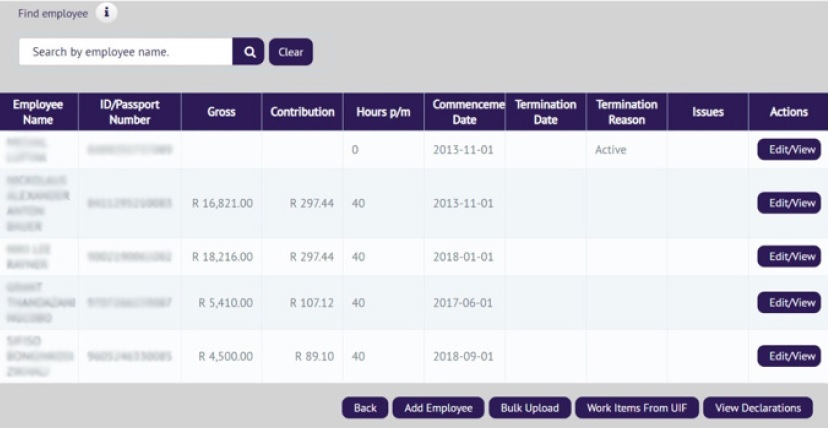

Step 4 : Then go to the declarations manager and click on your company to see which employees are declared. If there are any missing, click ‘Add Employee’ (you can only add employees you have been making UIF contributions for)

5. You will need to add the following information about the employee

a. ID or passport number

b. Gross Salary

c. Salary after deductions

d. Physical Address (with postal code)

e. Postal Address (with postal code) – if different from physical address

6. After this is done these employees will be added to your profile automatically.

7. Go back to https://uifecc.labour.gov.za/covid19/ regularly to check the

status of the payment. Declarations can take up to 3 working days.

Guidelines :

https://www.southafricain.com/uploads/pdf2020/15076-UIF.pdf

FAQ On UIF COVID-19 TERS Application

Frequently Asked Questions (FAQ) On UIF COVID-19 TERS Application

1. What if one of my employees is not on either of these reports?

This employee was not loaded. Please load them manually rather than using the CSV upload as there are less likely to be mistakes made.

2. I have received payment but am not sure how much to pay each employee?

Check the successful payment report where the payment is broken down by employee

3. I did not get paid as much as I was expecting?

The benefit an employee can receive under this scheme will be capped to a maximum amount of R6,730.56 per month per employee.

The maximum salary taken into account incalculating the benefits will be R17,712 per month and the employee will be paid in terms of the income replacement sliding scale (38%-60%) as provided for in the unemployment act.

4. I need to add more people to my claim?

You are able to add in new people to your claim:

** Login to the Covid-19 TERS Portal

** Select – “Employee Details”

** Click the orange Add new employee button

If you are adding employees you will need to do this one-by-one rather than with the CSV

5. What happens if the lockdown is extended?

** The UIF will make payment for a maximum of 3 months.

** If your organisation remains closed during level 4 lockdown, they will be able to continue claiming for TERS (for up to 3 months)

** Applications for May have not yet opened. Keep checking the website for notification of when it opens

Benefits of UIF COVID-19 TERS

The Unemployment Insurance Fund (UIF) COVID-19 Temporary Employer/Employee Relief Scheme (TERS) is a government initiative aimed at providing financial support to employees who have lost their income due to the COVID-19 pandemic. Here are some benefits of the UIF COVID-19 TERS:

Financial Assistance:

The primary benefit of the UIF COVID-19 TERS is financial assistance for employees who have lost their income due to the pandemic. This assistance can help to cover basic living expenses and reduce financial stress during a difficult time.

Job Security:

By providing financial support to employees, the UIF COVID-19 TERS can help to protect jobs and prevent further job losses. This can benefit both employees and employers, as it helps to maintain stability in the workforce.

Streamlined Application Process:

The application process for the UIF COVID-19 TERS is designed to be quick and easy, with online applications and quick turnaround times for approval and payment.

i m still waiting since June.

Why don’t i receive my ters payment from January till now is because my employer didn’t apply,but im still not back to work

It’s possible that I can claim the money that I did not get from the past months

Some of us since uif ters paying we not even get any cent when we try to ask we no get clarity my company tretening us and now I’m out from them dismissed me because of that covid money we need help please .

Who is qualifying for the ters, as workers working for the same company are not all earning the ters and that makes the inconsistency and bitterness among the employees. Please explain