Absa Siyasizana Relief Plan Programme

Organization : Absa Bank

Facility Name : Absa Siyasizana Relief Plan Programme

Location : Johannesburg

Website : https://www.absa.co.za/personal/loans/manage-my-debt/absa-siyasizana/

| Want to comment on this post? Go to bottom of this page. |

|---|

Absa Siyasizana Relief Plan Programme

Absa Siyasizana Struggling with debt repayments? We can help

During lockdown and the COVID-19 shutdown of the economy, Absa Siyasizana was formed to provide temporary financial relief for customers who were affected. We provided quick, temporary financial relief to over 730 000 customers with a total value of more than R9 billion.

The economy has restarted and so our short-term Payment Relief Programme has ended. However, Absa Siyasizana is still here to help our customers who are struggling with debt repayments.

Purpose

Financial difficulties can be stressful but they don’t have to be permanent. We understand that life doesn’t always go in the direction we want. So, if you are struggling to make your debt repayments or think you are going to miss a debt repayment, talk to us.

Siyasizana means ‘helping each other’ and if you are in a financial difficulty, we are always here to help you move forward.

How to Apply?

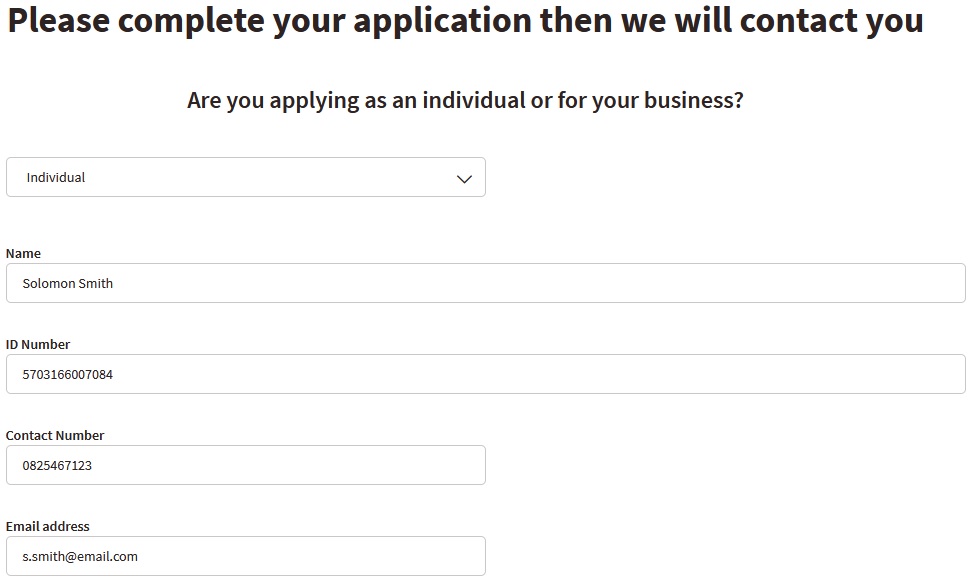

Just follow the below steps to apply for the Absa Siyasizana Relief Plan Programme.

Steps :

Step 1 : Visit the official website of Absa Bank through provided above.

Step 2 : Read the instructions carefully and click on the “Talk to us” button.

Step 3 : Fill the application form with the required details.

Step 4 : Finally click on “Submit” button to complete your application.

FAQs

1. What can you do immediately?

** Be committed to paying your monthly financial agreements, including credit cards, store cards, utility bills and any other financial obligations.

** Only apply for any additional loans if you know you can afford to pay the monthly repayment amount that comes with the purchase.

** Look out for sale items that you are certain you will use on a regular basis.

** Track your financial standings by creating a monthly budget which details your monthly income and expenditure

** Make use of your budget to identify areas where you can reduce spending and save. It is essential to stay in a debt-free positive territory.

** Determine your net worth using the below calculation:

** Total assets – Total liabilities = Net worth

** Total assets: Combine all your money from your savings or cheque accounts, trust funds, property value, car value, stock value, etc.

** Total liabilities: Combine all your debts such as home mortgage, credit card balance, etc

** Your goal is to have a positive net worth value at all times and it should be increasing as time goes by.

2. What can you do in the long term?

Controlling your debt? Now focus on your financial future

** Start investing any money you won’t need for at least seven years.

** If you have children and want to invest in their future, ensure that you put money away for them to use to pay for university or a new car.

** When investing in a home, buy a house that you can really afford, and over time it will increase in value. If you currently have a house with a bond you can’t afford, consider selling your house.

** Lower your monthly repayments by applying to consolidate your debt with your home loan.

** Invest in yourself and increase your earning power. Look at what people with your skills are earning in the market, and benchmark your earnings against this.

Maybe it is time to apply for a new job or take a course to develop your skills. If you have spare time, find a part time job or arrange to work overtime if moving to a new job is not an option.

Need help?

Talk to us now. Absa Siyasizana will connect you with the right people to see how we can help and what solutions there are for you. Complete our quick form and we’ll get back to you to discuss a way forward!

Need more help :

Call us directly on 0861 22 22 72

Please note our office hours are:

Monday – Friday – 08h00 to 16h30

Saturday – 08h00 to 13h00

Public holidays – Closed