sarsefiling.co.za SARS How Do I Pay? : South African Revenue Service

Organization Name : South African Revenue Service

Facility Name : How Do I Pay?

Head Office : Cape Town

Website : http://www.sarsefiling.co.za/

| Want to comment on this post? Go to bottom of this page. |

|---|

SARS Payments

Taxpayers, both individuals and businesses, are required to be fully tax compliant through on time submission of returns and payments, to avoid penalties and interest being charged.

Important Notes

** If the submission date falls on a weekend or public holiday, you need to submit the return/declaration together with your payment, if applicable, by the last business day before the weekend or public holiday.

** In instances where taxpayers are not compliant and have outstanding tax debt, the Debt Management department is committed to assisting businesses and individuals to become fully compliant.

Payment Options

Currently there are a number of options available to you if you want to make a payment to SARS

1. At a bank :

Payments to SARS can be made at the following banks: Absa, FNB, Nedbank, Standard Bank and Capitec. Please quote the correct beneficiary ID and payment reference number (PRN).

Top tip : Air Passenger Tax (APT) payments can only be made at Absa, Nedbank, FNB and Standard bank branches.

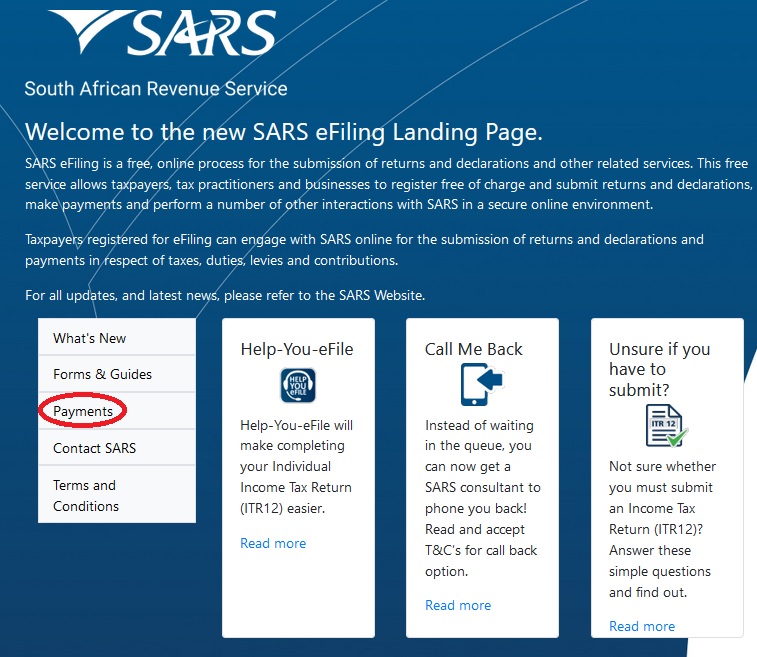

2. Payments via eFiling :

Taxpayers are advised to set-up a credit push option or use one of SARS’ alternative methods of payment.

With a Credit push, the payment is performed by you, the bank account holder. When making a payment to SARS, eFiling will send a payment request to your bank which will reflect the amount that needs to be paid on the relevant bank product.

The taxpayer then authorises this request normally via the relevant bank product. This forms an instruction to the bank to make the payment to SARS.

Credit Push payments are considered to be irrevocable and can only be made if the account holder has the necessary funds. A Credit Push transaction can be cancelled only before it is approved.

The following banks can be used for eFiling payments : Absa, Bidvest Bank, Capitec Bank, Citibank, FNB, HSBC, Investec, Nedbank, Standard Bank, Standard Chartered, Mercantile Bank, AlBaraka, Sasfin and HBZ.

3. Payments via SARS MobiApp :

Payment is made via your Statement of Account or your Notice of Assessment (ITA34). The principle of making a payment to SARS is the same on both accounts however note the following

** When making a payment from your Statement of Account (SOA) you may pay an amount determined by you to SARS.

** When making a payment from your Notice of Assessment (ITA34) you must pay the full amount due by you to SARS.

Top tip : Remember to consult the result icons displayed on your device to establish the status of the payment.

4. Electronic Funds Transfer (EFT) :

Payment may be made via the internet banking facilities by simply using the standard drop-down listing of pre-loaded beneficiary IDs provided by the bank. All SARS beneficiary IDs are prefixed with the naming convention “SARS- <Tax Type>”.

All internet payments must be correctly referenced to ensure that SARS is able to identify your payment and correctly allocate it to your account. You will not be able to make a payment if your reference is incorrect.

The following banks support this method: ABSA, AlBaraka, Grobanks Ltd (previously Bank of Athens), Capitec, FNB, HSBC, Investec, JP Morgan, Mercantile Bank, Nedbank and Standard Bank.

5. At a SARS Customs branch :

** SARS Revenue branches – no longer accept cash payments or cheque payments. Cash and cheque payments to SARS can be made at a bank as indicated above.

** Customs and Excise branches – cash and cheque payments are accepted.

6. Foreign payments :

Please note : This payment method should only be used by foreign taxpayers where no other payment options or channels are available e.g. where payments using eFiling, internet banking (EFT) or payment at a bank is not available.

Top tip : If a foreign taxpayer has a South African bank account, this payment method may not be used.

Payments can be made electronically into SARS’ bank account using the standard SWIFT 103 message and the Beneficiary ID/Account Number “SARS-FOR-999”. Only FNB supports this method.

Change Banking Details

If you need to change your banking details you can do it

** On eFiling if you’re a registered eFiler

** On the SARS MobiApp by clicking on the Profile Management button.

** In person at any SARS branch if you’re not registered with eFiling (this may require you to make an appointment).

** When completing and submitting your Income Tax Return for Individuals (ITR12).