osti.co.za Lodge A Complaint : Ombudsman For Short Term Insurance

Organisation : Ombudsman For Short Term Insurance

Service Name : Lodge A Complaint

Applicable For : South Africa Residents

Website : osti.co.za/lodge-a-complaint/

| Want to comment on this post? Go to bottom of this page. |

|---|

OSTI Lodge Complaint

If you want to submit a complaint to OSTI, send a completed application for assistance form to our office.

Types of Complaints

OSTI has jurisdiction to deal with any short-term insurance matter where :

** The insurer is a member of OSTI;

** The claim is within its monetary jurisdiction.

Unless:

** The complaint is already being handled by an attorney, except where the attorney is helping you to lodge a complaint to OSTI;

** The subject-matter of the complaint is already part of litigation in court or arbitration;

The complaint is about one of the following types of insurance cover:

** Accounts receivable

** Aviation

** Construction guarantees

** Crop insurance (including stock put through cover)

** Deterioration of stock

** Engineering

** Fidelity claims

** Loss of profits

** Machinery breakdown

** Marine

** Third party, computer and funds transfer theft

Third party claims (except for third party claims where the policyholder has not been indemnified) including but not limited to

** Motor third party liability;

** Contractor’s liability;

** Directors’ and officers’ liability;

** Employer’s liability;

** Employment practises liability;

** Public liability.

How To Lodge Complaint?

There are two ways in which you can complete an application, either online or by downloading the application form, filling it in and sending it back to us:

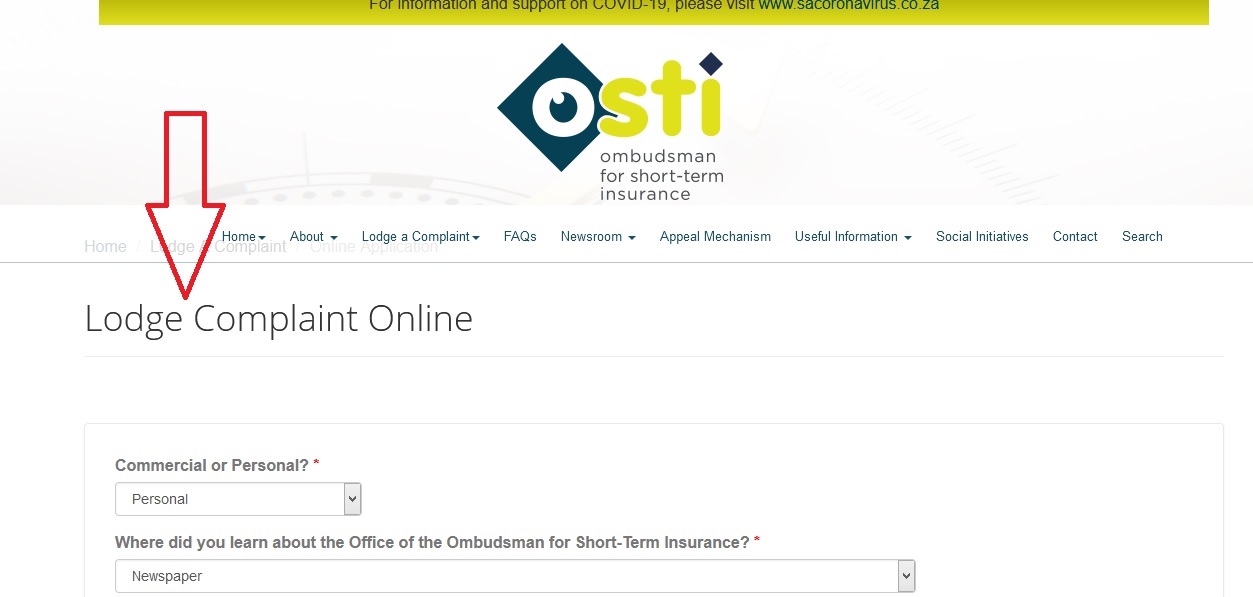

Online application :

osti.co.za/lodge-a-complaint/online-application/

Download application forms :

https://www.osti.co.za/lodge-a-complaint/download-application-forms/

You can send the filled in application form to:

E-mail: info@osti.co.za

Fax: 011 726 5501

PO Box: 32334, Braamfontein, 2017

If you need our help with filling out the form you can contact us at 011 726 8900 / 0860 726 890 and we will gladly help you to fill out the form. Or, you are welcome to come in and see us at 1 Sturdee Avenue, First Floor, Block A, Rosebank, and we will help you complete the application form.

Terms and Conditions

** In respect of complaints, the amount in dispute may not exceed R3.5 million and in the case of home owners or building policies, the amount in dispute may not exceed R6.5 million.

** The matter will be regarded as confidential as between the complainant, the insurer and/or the broker and the office of the Ombudsman.

** Any finding of the Ombudsman shall not be binding on the complainant and the complainant’s legal rights against the Insurer are not affected thereby.

** The Ombudsman will decide what should be disclosed to the complainant and/or the Insurer.

** The Ombudsman will collect, store, process and share the complainant’s personal information for purposes of this complaint.

** Documents brought into being as a result of this complaint shall not be liable to disclosure or be the subject of a discovery order or subpoena in the event of proceedings between the complainant and the insurer and/or the broker.

** The Ombudsman will not be subpoenaed to give evidence on the subject of the complaint in any proceedings and the complainant waives any rights which he/she/it may have to do so.

** The services rendered by the Ombudsman are not the same as those rendered by a professional legal adviser and are confined purely to recommendation, mediation or conciliation in an attempt to resolve complaints.

Covid-19:

We are working from home during the lockdown period and will endeavour to respond to your emails in a timely manner. You can contact us on our office numbers during office hours. If you are unable to reach us, please leave a message on our website or send an us an email and we will contact you as soon as possible. Stay safe and healthy.

Contact

Tel: 011 726-8900 | Fax: 011 726-5501 | Sharecall: 0860 726 890 | E-mail: info@osti.co.za

FAQ On Ombudsman For Short Term Insurance

Frequently Asked Questions FAQ On Ombudsman For Short Term Insurance

Q: What is the Ombudsman for Short Term Insurance?

A: The Ombudsman for Short Term Insurance (OSTI) is an independent organization that helps consumers resolve disputes with their short-term insurance providers in South Africa.

Q: How can I contact the Ombudsman for Short Term Insurance?

A: You can contact the OSTI by visiting their website at www.osti.co.za, emailing them at info@osti.co.za, or calling them at 0860 726 890.

Q: What types of complaints can the Ombudsman for Short Term Insurance help me with?

A: The OSTI can help consumers with complaints related to short-term insurance, such as disputes over claims, policy cancellations, premium increases, and other issues.

Q: Is there a fee for using the services of the Ombudsman for Short Term Insurance?

A: No, the services of the OSTI are free of charge for consumers.

Q: How does the Ombudsman for Short Term Insurance resolve disputes?

A: The OSTI resolves disputes by conducting an investigation into the matter and making a recommendation for a fair settlement to both parties.