UIF Validate e-Compliance Certificate : uifcompliance.labour.gov.za

Organization : South African Department of Labour (www.labour.gov.za)

Facility Name : Validate e-Compliance Certificate

Applicable For : All Employers

Website : uifcompliance [dot] labour [dot] gov [dot] za

| Want to comment on this post? Go to bottom of this page. |

|---|

How To Validate UIF e-Compliance Certificate?

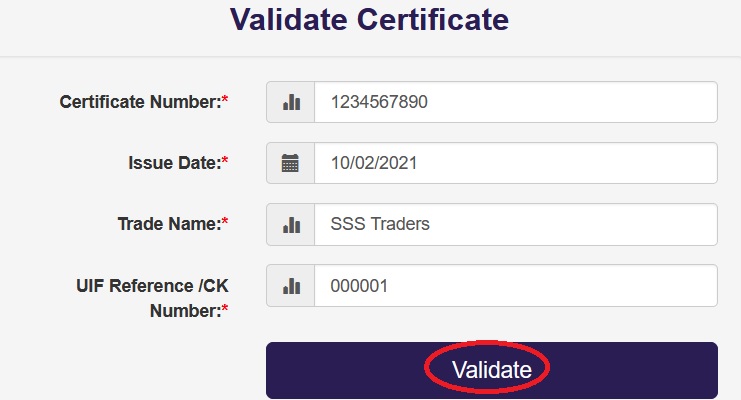

Kindly follow the below steps to Validate e-Compliance Certificate.

Steps to Proceed:

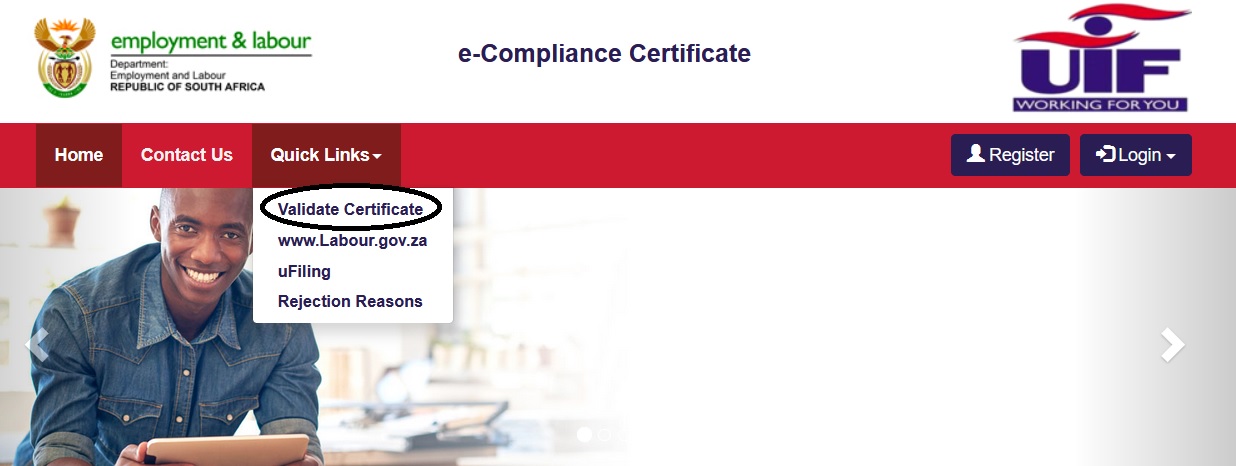

Step 1 : Visit the official website through provided above

Step 2 : Enter Your Certificate Number

Step 3 : Enter Your Issue Date

Step 4 : Enter Your Trade Name

Step 5 : Enter Your UIF Reference /CK Number

Step 6 : Finally click on “validate” button to validate your certificate.

e-Compliance Rejection Reason

| Rejection Code | Description |

| R504 | Outstanding contributions!! |

| R106 | Employer contribution Gaps |

| R101 | Employer has more than 11 months (pre 2019) or 1 month (post 2019) of continuous declaration gap |

| R102 | There must be a single declaration in every 12 months period for each employee |

| R103 | Not even a single declaration since commencement of the employer |

| R107 | Employee has no declaration in employment start month, If the outstanding declaration gap under this code is a date before April 2002, please submit declarations only from April 2002. |

| R503 | Zero payments!! |

| R502 | The first declaration period is not the same as the Employee start date. |

| R501 | Outstanding Declarations |

| R104 | There is no declaration in the commencement month of the employer |

| R105 | Employees have declaration gap of more than 11 months |

| R502 | The first declaration period is not the same as the Employee start date. |

| R501 | Outstanding Declarations |

| R104 | There is no declaration in the commencement month of the employer |

| R105 | Employees have declaration gap of more than 11 months |

FAQ On UIF e-Compliance Certificate

1. What if one of my employees is not on either of these reports?

This employee was not loaded. Please load them manually rather than using the CSV upload as there are less likely to be mistakes made.

2. I have received payment but am not sure how much to pay each employee?

Check the successful payment report where the payment is broken down by employee

3. I did not get paid as much as I was expecting?

The benefit an employee can receive under this scheme will be capped to a maximum amount of R6,730.56 per month per employee.

The maximum salary taken into account incalculating the benefits will be R17,712 per month and the employee will be paid in terms of the income replacement sliding scale (38%-60%) as provided for in the unemployment act.

4. I need to add more people to my claim?

You are able to add in new people to your claim:

** Login to the Covid-19 TERS Portal

** Select – “Employee Details”

** Click the orange Add new employee button

If you are adding employees you will need to do this one-by-one rather than with the CSV

5. Can I pay outstanding penalties and interest on uFiling?

No, uFiling does not allow for the payment of penalties and Interest. Please contact the UIF directly to obtain the correct amounts for penalties and Interest.

The UIF will then provide you with the correct reference numbers and account number to use when paying penalties and Interest.

Benefits of UIF Validate e-Compliance Certificate

The UIF Validate e-Compliance Certificate is a document that verifies an employer’s compliance with the Unemployment Insurance Fund (UIF) requirements in South Africa. Some benefits of obtaining the certificate include:

Compliance with the law:

The certificate confirms that an employer has met the legal requirements for registering with the UIF and submitting contributions on behalf of their employees.

Access to UIF benefits:

Employers who are compliant with the UIF regulations are able to access benefits for their employees, such as unemployment benefits, illness benefits, and maternity benefits.

Reduced risk of penalties:

Non-compliance with UIF regulations can result in penalties and legal action. By obtaining the e-Compliance Certificate, employers can reduce the risk of facing penalties or legal action.