African Bank Consolidation Loan Online Application : africanbank.co.za

Organization : African Bank Limited

Facility : Apply For Consolidation Loan

Website : https://africanbank.co.za/en/home/product-consolidation-loan/

| Want to comment on this post? Go to bottom of this page. |

|---|

African Bank Consolidation Loan

Things work better when we work together. Make the most of your budget when you combine your loans today. Mix ‘n match up to 5 loans into 1 easy-to-manage Consolidation Loan to the value of R250 000 and save cash with a lower repayment

How to Apply for African Bank Consolidation Loan?

Just follow the below steps to apply for Personal Loan online,

Steps :

Step 1 : Visit the official website of African Bank through provided above.

Step 2 : Read the instructions carefully and click on “Apply Now” button.

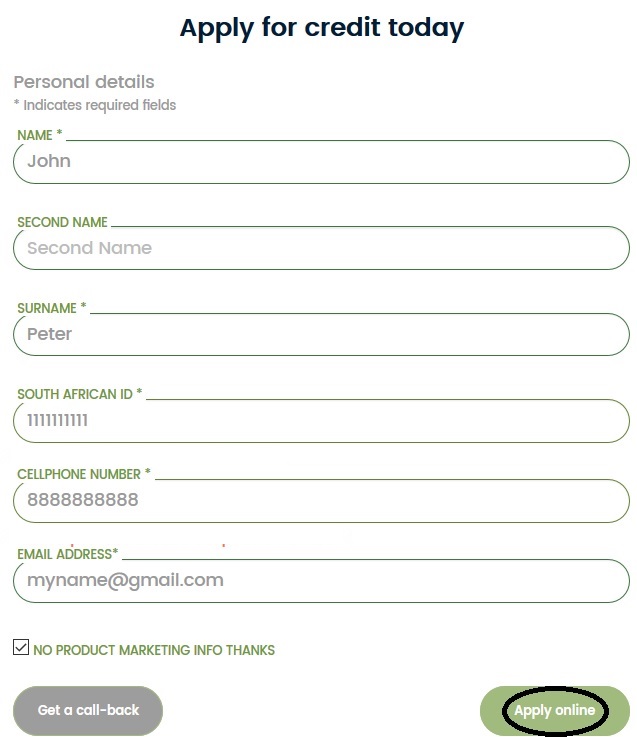

Step 3 : Fill the registration form with the required details.

Step 4 : Agree the terms & conditions and click on “Apply Online” button.

Step 5 : Fill the remaining details to complete the application.

What You Need?

For an African Bank Consolidation Loan offer suited to your lifestyle, you will need to have the following documents on hand

** Most recent proof of income e.g. latest payslip

** You must be over 18 to apply for a Loan

** Latest 3 months bank statements, reflecting 3 salary deposits

Credit Life Insurance

Rest assured that your credit is insured should anything happen to you that would prevent you from making repayments.

Settlements :

As a Category A Consumer, you’ll be covered (either to settle your outstanding obligation in terms of your credit agreement/facility or pay installments towards your credit agreement) in the event of death, permanent disability, temporary disability, retrenchment, unpaid leave or short time.

Installments :

Choose your Break is a unique African Bank feature that we offer you as an existing customer, enabling you to take a break from payment on qualifying loans.

Exclusions :

If you are a Category B Consumer, you will be covered for Death only (we settle your loan and/ or credit card debt).

FAQ On African Bank Consolidation Loan

Frequently Asked Questions FAQ On African Bank Consolidation Loan

1. What can I do if I find myself over-indebted?

If you fall behind with payments or that you have way too much debt to cope with, please call us on 011 207 4500.

Unfortunately if you don’t contact us immediately, we will notify you of your default and advise that you refer your issue to a debt counsellor, consumer court or alternative dispute resolution.

For more information on debt consolidation, debt counselling or debt management, contact the National Credit Regulator on 0860 100 406

2. What happens if I haven’t paid my amounts owing and am in arrears?

If this happens you need to contact us immediately and we will do our best to try and find a solution for you.

Unfortunately if you don’t contact us, or we can’t help you find a solution, we need to give you at least 20 business days’ notice before submitting your information to the credit bureau.

3. Can I pay off my Loan or Credit Card early?

Yes. You can call us for a settlement amount if you want to settle your outstanding balance. Or you can increase your repayment amounts to pay off your Loan or Credit Card quicker. Feel free to call us on and to discuss your options.