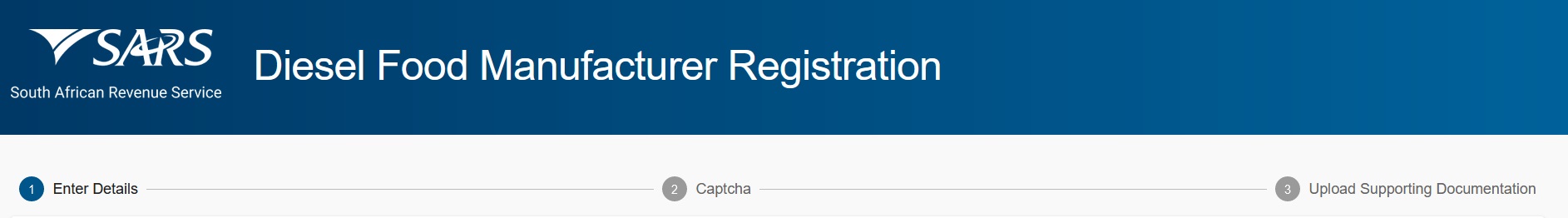

SARS Diesel Food Manufacturer Registration : South African Revenue Service

Organisation : SARS South African Revenue Service

Facility Name : Diesel Food Manufacturer Registration

Country :South Africa

Website : https://www.sars.gov.za/individuals/i-need-help-with-my-tax/use-our-digital-channels/

| Want to comment on this post? Go to bottom of this page. |

|---|

How To Register For SARS FM Diesel Refund?

To register For SARS FM Diesel Refund, Follow the below steps

Step-1 : Go to the link https://tools.sars.gov.za/sarsonlinequery/DieselRefundsRegistration

Step-2 : Enter your Entity Details, Requestor Details and Requestor Additional Details

Step-3 : Enter the Captcha and Upload Supporting Documentation

FAQ On SARS FM Diesel Refund

Frequently Asked Questions FAQ On SARS FM Diesel Refund

What is the SARS FM Diesel Refund?

The SARS FM Diesel Refund is a scheme that allows food manufacturers to claim a refund for diesel used in the manufacture of foodstuffs. The scheme is intended to help reduce the cost of food production and make South African food more competitive in international markets.

Who is eligible for the SARS FM Diesel Refund?

Food manufacturers who are registered for value-added tax (VAT) and who use diesel in the manufacture of foodstuffs are eligible for the refund. Foodstuffs are defined as any product that is intended for human consumption and that is not a beverage.

How do I register for the SARS FM Diesel Refund?

To register for the SARS FM Diesel Refund, you will need to complete the DA185 form and Annexure DA185.4A3. These forms are available on the SARS website and at any SARS office. You will also need to gather the required supporting documents, which may include a copy of your company’s registration certificate, tax clearance certificate, bank account details, proof of ownership of the manufacturing premises, and diesel consumption records.

What SARS Does?

The South African Revenue Service (SARS) is the nation’s tax collecting authority. Established in terms of the South African Revenue Service Act 34 of 1997 as an autonomous agency, we are responsible for administering the South African tax system and customs service.

Our Strategic Intent:

To give effect to our mandate, our strategic intent is to develop and administer a tax and customs system of voluntary compliance, and where appropriate, enforce responsibly and decisively.

Our 9 Strategic Objectives:

** Provide CLARITY and CERTAINTY for taxpayers and traders of their obligations

** Make it EASY for taxpayers and traders to comply with their obligations

** DETECT taxpayers and traders who do not comply, making non-compliance HARD and COSTLY

** Develop a HIGH performing, DIVERSE, AGILE, ENGAGED and EVOLVED workforce

** Increase and expand the use of DATA within a comprehensive knowledge management framework

** Modernise our systems to provide DIGITAL and STREAMLINED online services

** Demonstrate EFFECTIVE STEWARDSHIP of our resources to ensure EFFICIENCY and EFFECTIVENESS in the delivery of quality outcomes and performance excellence

** Work with and through STAKEHOLDERS to improve the TAX ECOSYSTEM

** Build PUBLIC TRUST and CONFIDENCE in the tax administration system