Rand Mutual Assurance (RMA) : Submit Claim Online

Organisation : Rand Mutual Assurance (RMA)

Facility Name : Submit Claim Online

Country : South Africa

Website : https://www.randmutual.co.za/information-zone

| Want to comment on this post? Go to bottom of this page. |

|---|

How To Submit RMA Claim Online?

To Submit Rand Mutual Assurance (RMA) Claim Online, Follow the below steps

Related / Similar Facility : RMA Register For Online Services

Steps:

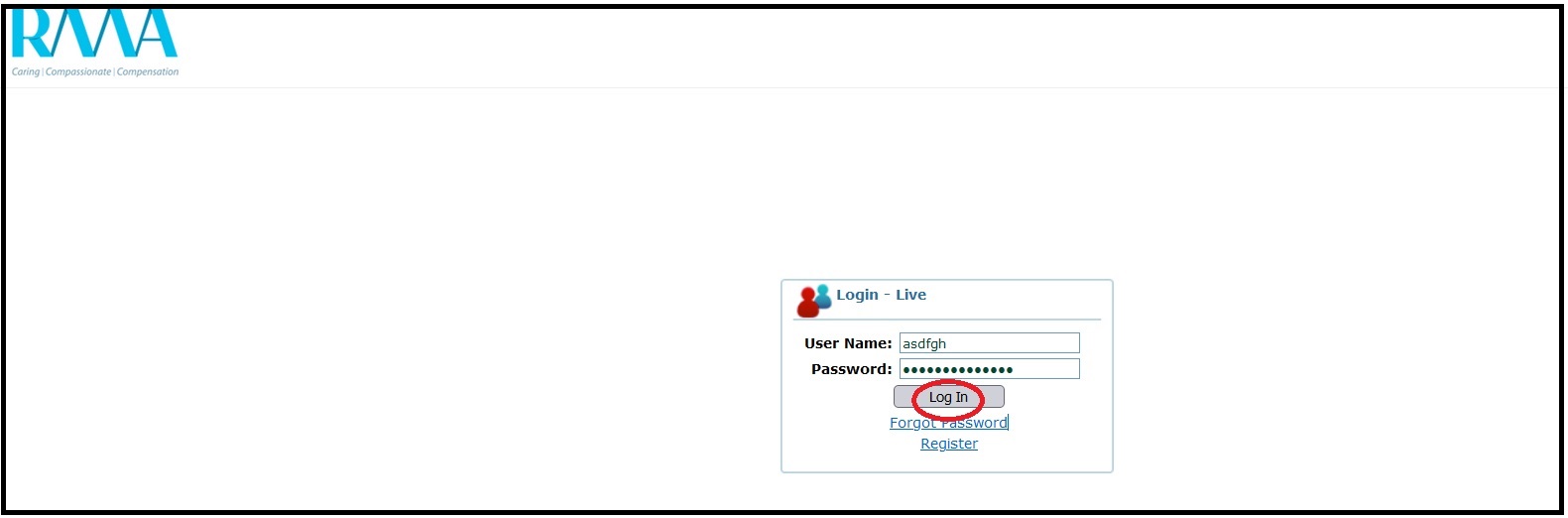

Step-1 : Go to the link https://member.randmutual.co.za/logon.aspx?ReturnUrl=%2flogin.aspx

Step-2 : Enter the User Name and Password

Step-3 : Click On Log In Button.

Instructions For RMA Claimants

RMA goes the extra mile to care for you and your family if you have been injured at work or have contracted a work-related disease. If you are fatally injured in a work-related accident, RMA goes to great lengths to track down your beneficiaries, even if they are living in hard to reach rural areas, to ensure that they receive their rightful compensation and are cared for in their time of need.

If you are injured or have contracted an illness at work, you need to:

Inform your employer immediately by means of your company’s internal procedures. Your employer must report the accident to RMA within seven days from the date of the accident for all injuries, or within 14 days of diagnosis of disease.

Submit the following documents to your employer who will in turn need to submit these to RMA together with your claim:

** Certified copy of your ID or passport.

** Proof of banking details in order for us to be able to make payment directly into your bank account.

Contact details in order for us to be able to contact and communicate with you. We require:

** Your full residential and/or postal address.

** Your cell number.

** Your email address (where applicable).

** Completed Section 51 document if you are under the age of 26 years or if you are a learner or trainee.

** Medical reports – your first medical report from your treating doctor must be submitted with your original claim, however, additional medical reports are required during the course of your treatment so that we may track your progress, particularly in the case of Temporary Total Disablement (TTDs), also known as days off or temporary income replacement benefit.

** Final assessment – this is the final document that will be submitted to RMA regarding your claim. You should not resume work unless the final assessment has been conducted by the treating doctor. This assessment allows RMA to assess if there is any permanent disablement in terms of COIDA. Should there be permanent disablement, you are entitled to compensation. If the injury is assessed at between 1% and 30% you will receive a lump sum payment. If the injury is assessed at between 31% and 100% you will be on a disability pension for life.

FAQ On RMA Claimants

Frequently Asked Questions FAQ On RMA Claimants

1. Q: How do I obtain pre-authorisation?

A: The treating doctor is required to complete an authorisation form which must include a treatment plan. This form is available on our website by following the Downloads – Healthcare Provider forms link.

Once the form has been received by RMA, the request is adjudicated by the medical department. If all the necessary requirements have been met, a pre-authorisation is generated and is communicated to both the doctor and the patient. Only on receipt of the authorisation can a patient consult the doctor.

2. Q: Can I go to any doctor when injured or can I only go to a provincial or state facility?

A: You can visit any doctor when injured. The treating doctor is required to complete a First Medical Report, and then followed by a Progress and Final Medical Report for each consultation attended or treatment carried out. These forms are available on our website by following the Downloads – Healthcare Provider forms link.

3. Q: How do I confirm that my invoice/s have been paid?

A: You need to obtain pre-authorisation before consulting a specialist for:

** Specialised investigations such as radiology, MRI scans and isotope studies

** Continued treatment after 1 year but within 2 years of the date of accident

** Any treatment after 2 years or when a case is re-opened for further treatment or investigation

4. Q: Will the medical service provider ask for cash or will he send the invoice to RMA?

A: The doctor should send the invoice directly to RMA. All medical invoices must be submitted electronically through the various switching houses. Payment is made within 30 days from date of receipt provided that all claim requirements have been met and RMA has accepted liability for the claim.

5. Q: The doctor made me pay cash, how do I get reimbursed?

A: You need to submit the invoice from the doctor, with proof of payment, as well as proof of banking details, to contactcentre@randmutual.co.za. The Proof of Banking Details form is available on our website by following the Downloads – Claimant/Pensioner Forms link. RMA will adjudicate the claim and if it is valid, you will be reimbursed.