gauteng.gov.za Grade 12 NSC Accounting Sample Question Paper 2018 : National Senior Certificate Examinations

Organisation : Department of Basic Education

Exam : National Senior Certificate Examinations

Document Type : NSC Sample Question Paper

Subject : Accounting

Category : Grade 12

Year : 2018

Website : https://www.gauteng.gov.za/Home

| Want to comment on this post? Go to bottom of this page. |

|---|

Grade 12 NSC Accounting Sample Question Paper

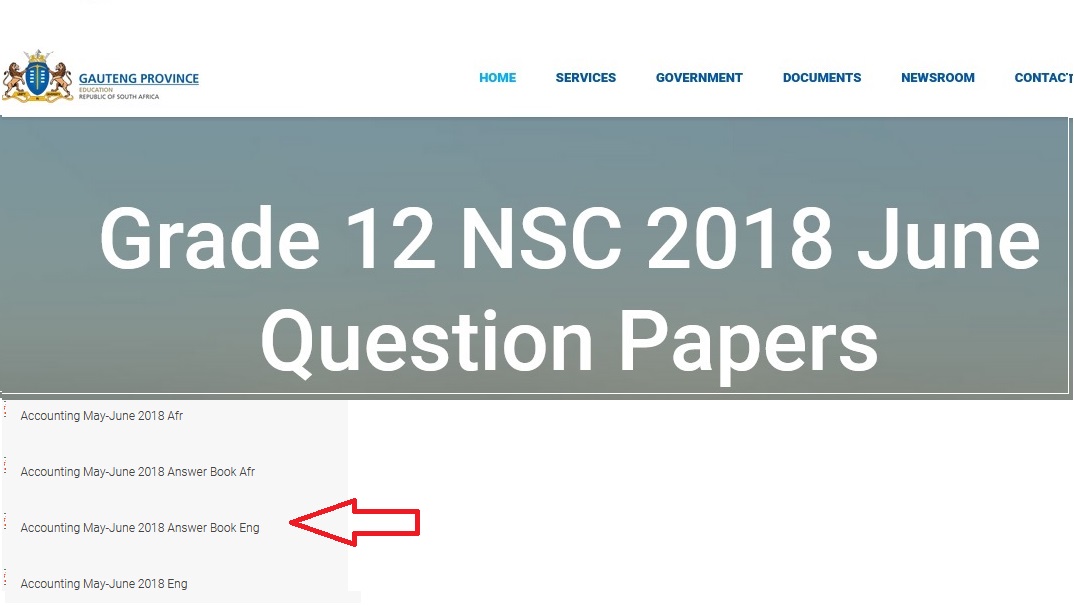

Download Grade 12 NSC 2018 June Question Papers from the official website of Department of Basic Education

MARKS: 300

TIME: 3 hours

Related / Similar Question Paper :

Gauteng Grade 06 Provincial Exam English Question Paper 2018

Gauteng Grade 06 Natural Sciences & Technology Question Paper 2018

Instructions & Information

** Read the following instructions carefully and follow them precisely.

** Answer ALL the questions.

** A special ANSWER BOOK is provided in which to answer ALL the questions.

** Show ALL workings to achieve part-marks.

** You may use a non-programmable calculator.

** You may use a dark pencil or blue/black ink to answer the questions.

** Where applicable, show ALL calculations to ONE decimal point.

** Write neatly and legibly.

Download Question Paper :

Acc Eng :

https://www.southafricain.com/uploads/pdf2019/14184-Acc.pdf

Acc Afr :

https://www.southafricain.com/uploads/pdf2019/14184-AccAfr.pdf

QUESTION 1 : BANK RECONCILIATION AND CONTROL (35 marks; 20 minutes)

The following information relates to Hartfield Suppliers for April 2018.

REQUIRED : 1.1 Bank reconciliation:

1.1.1 Show the entries that must be recorded in the Cash Journals by completing the table in the ANSWER BOOK. (14)

1.1.2 Calculate the Bank Account balance in the Ledger of Hartfield Suppliers on 30 April 2018. (3)

1.1.3 Prepare the Bank Reconciliation Statement on 30 April 2018. (8)

1.2 The internal auditor is concerned about the management of cash.

1.2.1 Explain TWO different problems to justify her concern. Quote figures. (4)

1.2.2 Give advice (TWO points) on how such problems can be avoided in future. (2)

1.3 Explain TWO benefits of using the electronic funds transfer (EFT) system rather than cheques for direct payments to suppliers. (4)**

B. Provisional totals in the Cash Journals on 30 April 2018 before receiving the Bank Statement:

• Cash Receipts Journal, R510 607

• Cash Payments Journal, R488 260

QUESTION 2: MANUFACTURING (45 marks; 30 minutes)

2.1 Choose ONE cost account for each of the following descriptions. Write only the cost accounts next to the question numbers (2.1.1 to 2.1.4) in the ANSWER BOOK. direct labour cost; direct/raw materials cost; factory overheads cost; administration cost; selling and distribution cost

2.1.1 Bad debts written off during the financial year

2.1.2 Pension fund contributions paid on behalf of the workers in the production process

2.1.3 Transport costs paid for raw materials purchased

2.1.4 Depreciation on office equipment (4 x 1) (4)

2.2 TIGHT-FIT MANUFACTURERS

The information relates to Tight-Fit Manufacturers, a business that manufactures denim jeans, for the financial year ended 31 March 2018.

REQUIRED: 2.2.1

Calculate : • The value of the closing stock of raw materials of fabric using the weighted-average method (4)

• The value of direct/raw materials issued for production (3)

• The correct factory overhead costs (6)

2.2.2 Complete the Production Cost Statement on 31 March 2018. (12)

2.2.3 The business purchases raw materials from an overseas supplier, although there are numerous local suppliers. Give TWO reasons why the business should support local suppliers. (2)

2.3 BREAK-TIME MANUFACTURERS

Break-Time Manufacturers is a manufacturing business that produces lunch boxes for school children.

REQUIRED:

2.3.1 Calculate the following for the year ended 30 April 2018:

• Direct labour cost

• Break-even point (2) (4)

2.3.2 Explain why the owner should be concerned about the break-even point. Quote figures. (3)

2.3.3 The owner is concerned about the direct labour cost.

• Explain why the owner would NOT be satisfied with the direct labour cost per unit. Quote figures.

• Give ONE solution to this problem. (3) (2)

QUESTION 3: INVENTORY VALUATION (40 marks; 25 minutes)

3.1 SPEEDY CYCLES

You are provided with information for the year ended 31 May 2018. The owner is Fred Fakude. The business sells different models of bicycles. Fred uses the periodic inventory system and the specific identification method to value stock.

REQUIRED:

3.1.1 Calculate:

• Value of the closing stock of bicycles on 31 May 2018

• Cost of sales for the year ended 31 May 2018

• Gross profit for the year ended 31 May 2018 (8) (4) (3)

3.1.2 Fred is satisfied that he is selling approximately 18 Cruze bicycles per month. However, he is concerned that the new Ryder model, despite its lower selling price, is not selling as quickly as the Cruze model.

• Calculate the selling price of a Ryder bicycle.

• Calculate the average number of Ryder bicycles sold per month.

• Indicate how long it will take Fred to sell the closing stock of the Ryder bicycles. Show calculations.

• Give ONE possible reason for the slow sales of Ryder bicycles, and give advice (ONE point) to Fred in this regard. (3) (3) (3) (4)

3.2 MANAGEMENT OF INVENTORIES: CELIA’S CLOTHING

Celia Mtolo owns a small clothing business. You are provided with information for the year ended 28 February 2018. The business sells T-shirts, jackets and pants. Celia took certain decisions at the beginning of the 2018 financial year.

Required :

Quote relevant figures for ALL the questions below.

3.2.1 T-shirts:

Explain why it was NOT a good idea to change to a cheaper supplier of T-shirts. State TWO points. (4)

3.2.2 Jackets:

Celia decided to change the supplier in 2018 and to change the mark-up %. How has this decision affected the business? State TWO points. (4)

3.2.3 Pants:

Celia reduced the selling price of pants significantly in the 2018 financial year in response to a new competitor who sells similar pants at R990. Based on the information below, make TWO separate suggestions to Celia to improve the profit on pants in 2019. (4)

Benefits of National Senior Certificate Exam

The National Senior Certificate (NSC) exam, also known as the Matric exam, is the final high school examination in South Africa. Here are some of the benefits of this exam:

Recognition of Achievement:

The NSC is a widely recognized qualification that shows that a student has completed their secondary education and is ready for further studies or employment.

Preparation For Tertiary Education:

The NSC exam is designed to prepare students for further studies at universities, colleges, or other institutions of higher learning. It provides them with the necessary academic knowledge and skills required for tertiary education.

Job Opportunities:

Many employers in South Africa require a National Senior Certificate as a minimum requirement for employment. Thus, the NSC increases a student’s job prospects and career opportunities.