African Bank Online Banking : africanbank.co.za

Organization : African Bank Limited

Facility : Online Banking

Website : https://www.africanbank.co.za/en/home/

| Want to comment on this post? Go to bottom of this page. |

|---|

How To Register For African Bank Online Banking?

We understand that time is important to you, which is why we have made online banking simple and easy to use. Save time using our quick ways to bank and save money because it is free-to-use.

Related / Similar Services : African Bank Apply For Personal Loan

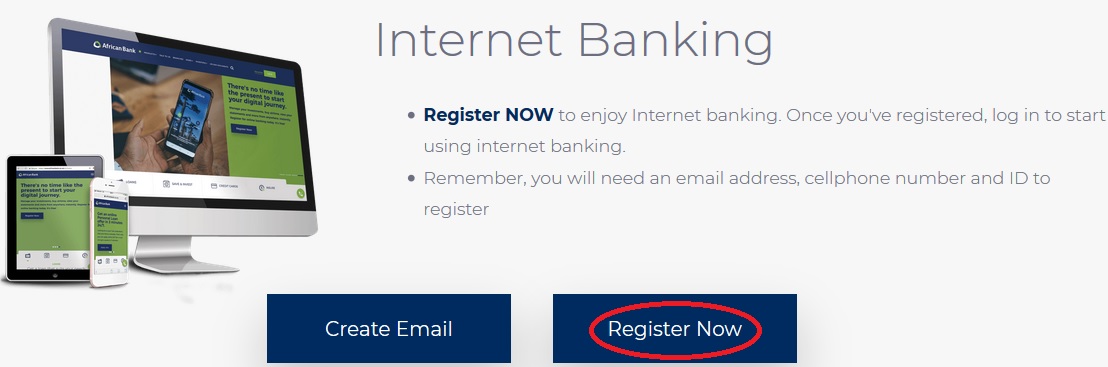

** Register NOW to enjoy African Bank Internet banking. Once you’ve registered, log in to start using internet banking.

** Remember, you will need an email address, cellphone number and ID to register

African Bank App

** Search for African Bank on the GooglePlay or AppStore to download and install.

** You will need an email address, cellphone number and ID to register

** Android 4.4 KITKAT and IOS version 9.3, iPhone 5 and later versions are compatible.

** Low-end devices may be incompatible due to feature limitations.

** Remember, you’ll need an email address to download the African Bank App.

How To Register For African Bank Cell Phone Banking?

** Register for African Bank cellphone banking with your consultant in branch or on Register NOW.

** Dial *120*225# to accept the terms and start banking from your phone.

FAQ On African Bank

Frequently Asked Question (FAQ) On African Bank.

1. How Do I Activate My African Bank Credit Card?

** You can activate your credit card at any African Bank Branch, on the African Bank Website, and log in to your Internet Banking profile or on your phone using the African Bank App.

** When visiting an African Bank branch please ensure that you have your South African Identity Document and your Credit Card to confirm details.

** You will be notified via SMS when you can start using your Credit Card.

2. How and when do I get my Loan?

** The first step is to apply for a Loan. You have the choice of applying online, over the phone or by visiting your nearest branch.

** Once you have applied for a Loan, your information will be reviewed and if the Loan is awarded to you, the Loan amount will be paid directly into your bank account.

3. How and when do I make Loan repayments?

** Your repayment dates are set out on the front page of your agreement.

** Your first repayment is due seven days after your Loan is deposited in your bank account. All other instalments are due on the first day of the month.

** Repayments can be made by setting up a payroll deduction or a debit or stop order from your bank account.

** Or, we can arrange to deduct the money from your bank account monthly on the day you are paid.

4. Can I pay off my Loan or Credit Card early?

Yes. You can call us for a settlement amount if you want to settle your outstanding balance. Or you can increase your repayment amounts to pay off your Loan or Credit Card quicker. Feel free to call us on and to discuss your options.

Benefits of African Bank App

The African Bank App is a mobile application that allows customers to manage their banking accounts and services on-the-go. Some benefits of using the African Bank App include:

Convenient banking :

The app provides a convenient and accessible way for customers to access their banking services at any time and from anywhere.

Easy access to account information :

The app allows customers to view their account balances, transaction history, and other account details at the touch of a button.

Quick and easy payments :

Customers can make payments and transfers quickly and easily using the app, without the need to visit a bank branch or ATM.

Increased security :

The African Bank App is designed with security features such as fingerprint or face recognition, and secure password authentication to ensure customers’ banking information is protected.

Improved budgeting and spending management :

The app allows customers to track their spending and manage their budgets more effectively by categorizing their expenses and setting up alerts for account activity.

Additional Simplified Procedure

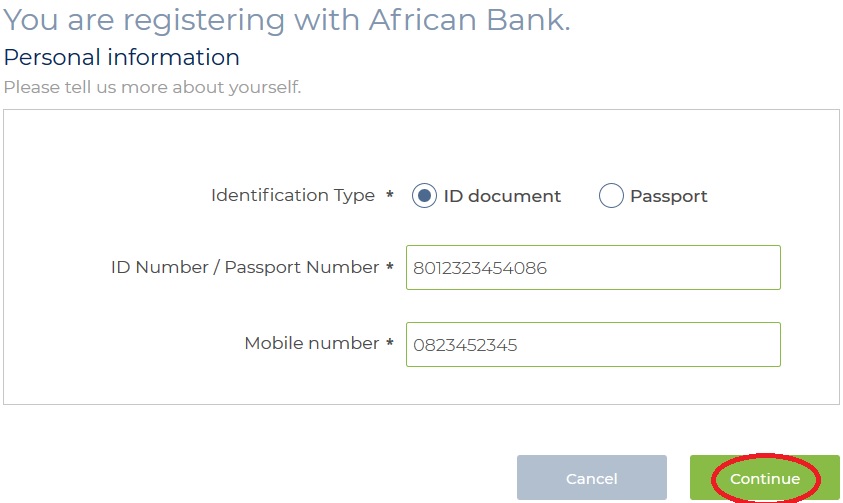

Here are the steps on how to register for African Bank Online Banking:

1. Go to the African Bank website: https://africanbank.co.za/en/home/register-or-login/

2. Click on the “Register” button.

3. Enter your email address, cellphone number, and ID number.

4. Create a username and password.

5. Read and agree to the terms and conditions.

6. Click on the “Register” button.

You will receive a confirmation email and SMS with a one-time PIN (OTP). Enter the OTP in the online form to complete your registration. Once you have registered, you can log in to your online banking profile and start managing your finances online.

Here are some things to keep in mind when registering for African Bank Online Banking:

** You must be a South African citizen or permanent resident to register for African Bank Online Banking.

** You must have a valid South African ID number.

** You must have a cellphone number and email address.

** You must read and agree to the terms and conditions before registering.

how to get login details for app if you forget them

Kindly send me a proof of payment for Nedbank as you did paid it for me. Nedbank need it in oder to pay me the funds due to me. . I have requested it for several times and even went to the branch but still I don’t get it.

When do i get my loan coz I’ve been waiting for a long time

I was apply for a loan from Wednesday it was approved but even now there is money in my account

Can you please call me I need help