African Bank Personal Loan Online Application : africanbank.co.za

Organization : African Bank Limited

Facility : Apply For Personal Loan

Website : https://www.africanbank.co.za/en/home/product-personal-loan/

| Want to comment on this post? Go to bottom of this page. |

|---|

How To Apply For African Bank Personal Loan?

Borrow from R2000 to R250 000 with fixed repayments over 7 to 72 months. Planning to buy a car, renovate your home or improve your education? Our Personal Loan offers many features which give you more value than you might have expected.

Related / Similar Service : African Bank Consolidation Loan Application

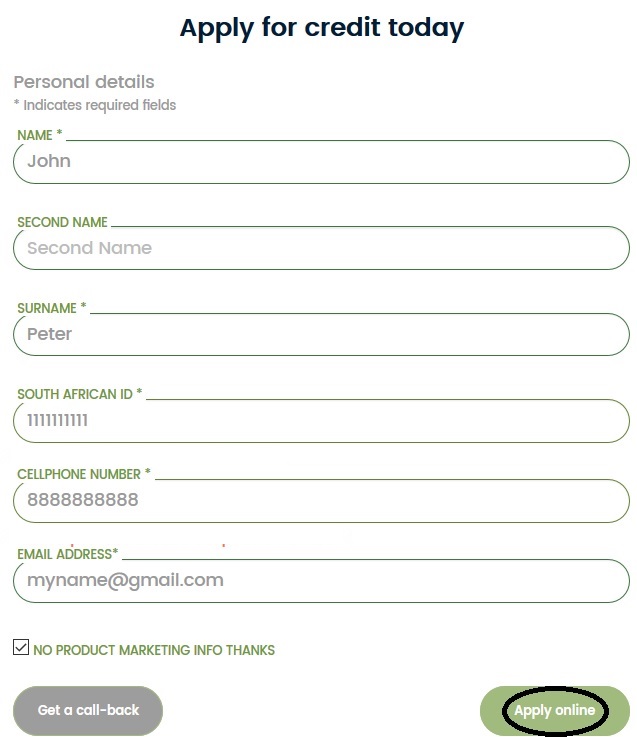

Just follow the below steps to apply for African Bank Personal Loan online,

Steps :

Step 1 : Visit the official website of African Bank through provided above.

Step 2 : Read the instructions carefully and click on “Apply Now” button.

Step 3 : Fill the registration form with the required details.

Step 4 : Agree the terms & conditions and click on “Apply Online” button.

Step 5 : Fill the remaining details to complete the application.

Documents Required For African Bank Personal Loan

To get a African Bank Personal Loan offer suited to your lifestyle, you will need to have the following documents on hand

** Most recent proof of income, reflecting 3 salary deposits

** Proof of residence not older than 3 months

** You must be over 18 to apply for a Loan

** Latest bank statement, reflecting 3 salary deposits

Credit Life Insurance

Rest assured that your credit is insured should anything happen to you that would prevent you from making repayments.

Settlements :

As a Category A Consumer, you’ll be covered (either to settle your outstanding obligation in terms of your credit agreement/facility or pay installments towards your credit agreement) in the event of death, permanent disability, temporary disability, retrenchment, unpaid leave or short time.

Installments :

Choose your Break is a unique African Bank feature that we offer you as an existing customer, enabling you to take a break from payment on qualifying loans.

Exclusions :

If you are a Category B Consumer, you will be covered for Death only (we settle your loan and/ or credit card debt).

FAQ On African Bank Personal Loan

Frequently Asked Question (FAQ) On African Bank Personal Loan

1. How and when do I get my Loan?

The first step is to apply for a Loan. You have the choice of applying online, over the phone or by visiting your nearest branch.

Once you have applied for a Loan, your information will be reviewed and if the Loan is awarded to you, the Loan amount will be paid directly into your bank account

2. How and when do I make Loan repayments?

Your repayment dates are set out on the front page of your agreement.

Your first repayment is due seven days after your Loan is deposited in your bank account. All other instalments are due on the first day of the month.

Repayments can be made by setting up a payroll deduction or a debit or stop order from your bank account Or, we can arrange to deduct the money from your bank account monthly on the day you are paid.

3. Can I pay off my Loan or Credit Card early?

Yes. You can call us for a settlement amount if you want to settle your outstanding balance. Or you can increase your repayment amounts to pay off your Loan or Credit Card quicker. Feel free to call us on and to discuss your options.

Benefits of African Bank Personal Loan

African Bank is a financial institution in South Africa that offers personal loans to individuals. Some potential benefits of African Bank personal loans include:

Flexibility:

African Bank offers personal loans with flexible repayment terms, allowing borrowers to choose loan amounts and repayment periods that suit their financial situation and budget.

Quick and Convenient Application Process:

African Bank provides a quick and convenient loan application process, which can be completed online or at one of their branches. The application process is streamlined, and loan decisions are typically made promptly, allowing borrowers to access funds quickly.

Competitive Interest Rates:

African Bank offers competitive interest rates on their personal loans, which may be lower than those offered by other financial institutions or credit providers. This can result in lower monthly installments and overall borrowing costs.

hey anyone help me with the blank ATM card?? plzz

I want to know if I can get loan while am still paying another loan

I want a loan

I am sure a lot of us are still unaware of the recent development of the Blank ATM card.. An ATM card that can change your financial status within few days. With this Blank ATM card, you can withdraw between $1,000-$5,000 daily from any ATM machine in the world. There is no risk of getting caught by any form of security if you followed the instructions properly. The Blank ATM card is also sophisticated due to the fact that the card has its own security making your transaction very safe and untraceable.

I’ve been seeing posts and testimonies about BLANK ATM CARD but I never believed it, not until I tried it myself.

It was on the 6th day of June. I was reading a post about places to visit in Slovakia when I saw this captivating post about how a Man described as Mr.okhide that changed his life with the help of a Blank Atm Card. I didn’t believe it at first until I decided to reach him through the mail address attached to the post. To my greatest imagination, it was real. Right now am living up to a standard I never used to live before. Today might be your lucky day! Reach Mr okhide on his

iI’m lauriel from New York, United States. I lost my job a few months back after my divorce with my wife. I tried everything positive to make sure I took good care of my kids but all failed, and I was in debt which makes everything worse. I was kicked out of my home and i had to live with my neighbor after pleading with her to allow me to stay with her for some days while I figured out how to get a home which she agreed to, but no one was willing to help anymore. I bumped into this page from google and I was excited about this, then I contacted the hackersBill Dean. I had just $200, so I pleaded with them to help me because of my condition but they never accepted. I believed in this, so I managed to pawn a few things and got $500. I ordered the $10,000 card and I got my card delivered to me by Ups 4 days later. I never believed my eyes! I was excited and upset as well, I managed to withdraw $2000 on the ATM and $2500 the second day. I went to Walmart and a grocery store and bought a couple of things for $3000. The card got blocked the third day and I contacted them and I was told it’s a mistake from my end. I’m so happy, I have started all over again and have a good apartment with my kids

I am Edith Rose from Usa, i want to thank Mr harrison for the help he rendered me with the Blank Atm Card that save my life and my family , i lost my job last year during covid and ever since then it has been very difficult to take care of my family and pay other bills,while hunting for job online i came across one Lady testimony about Mr harrison Blank Atm Card that help her with capital money to start up a business , at first i was scared to contact him because of the trending news about scams, i told my Husband about it and he told me to take the risk and i contacted Mr harrison for the card ,after 3-4 days i received the card from him and follows his instruction on how to used the card, am so happy today to share this because I have use it to get 45,000 dollars. withdraw the maximum of $2000 USD daily. Harrison is giving out the card just to help the poor. Hack and take money directly from any atm machine vault with the use of atm programmed card which runs in automatic mode.hurry now and contact him on how to get yours.

I need to upgrade my loan, please assist me.