How to Transfer into GEPF? : Government Employees Pension Fund

Organization Name : GEPF

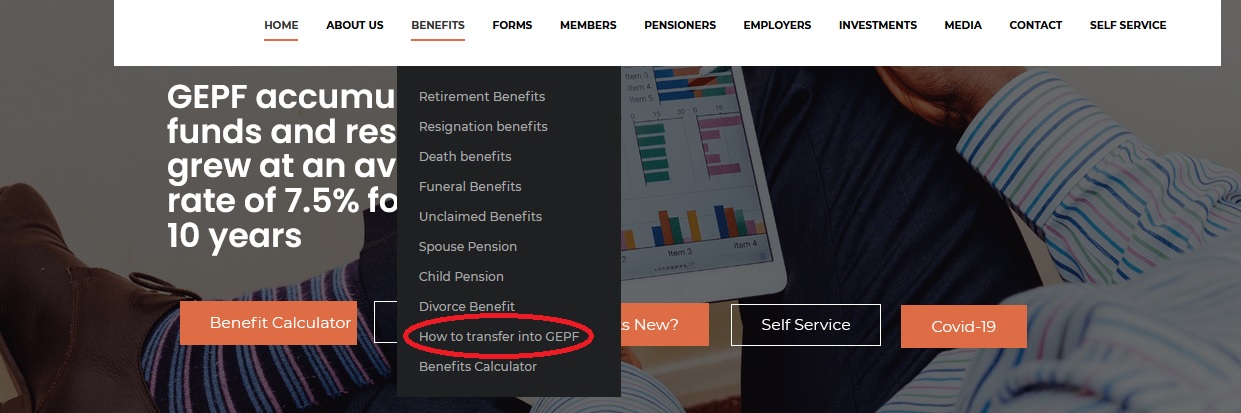

Facility Name : How to Transfer into GEPF?

Applicable For : Government Employees in South Africa

Website : https://www.gepf.co.za/how-to-transfer-into-gepf/

| Want to comment on this post? Go to bottom of this page. |

|---|

How to Transfer into GEPF?

In order to transfer funds into GEPF, you must be a contributing member, in other words, you must have already been given a pension number.

Related / Similar Service : GEPF Retirement & Resignation Benefits

Related / Similar Service : GEPF Self Service Registration

Steps to Follow:

** If you do not have a GEPF pension number, your employer needs to complete and submit an admission form (Z125), together with your first payslip in order for a pension number to be generated.

Once the pension number has been generated, you will then be able to transfer funds into GEPF.

** If you are already a GEPF member with a current pension number, the transferring fund should complete items A, B, D, and F of the Z1526 form and your current employer must complete items G and H.

This application form (Z1526) must be returned to GEPF to register your application to transfer into the Fund.

** Funds may only be transferred from approved retirement funds that are registered with the Financial Sector Conduct Authority (FSCA) and with South African Revenue Services (SARS)

** The transferring fund must send the Recognition of Transfer document (ROT) to GEPF to complete and return to them whereupon they will request approval from the FSB for the transfer value to be transferred.

** When your transferring fund has made the payment to GEPF, they must submit proof of payment. This proof of payment can be e-mailed to gepftransfers [AT] gpaa.gov.za and or Special.ProjectEnquiries [AT] gpaa.gov.za.

** Once the proof of payment has been received, the funds will be allocated to your pension number and an additional period of service will be calculated for the amount of money that was received, as GEPF is a defined benefit fund.

** Once the calculations are finalized, an explanatory letter will be sent to you and to your employer to inform you that the transfer has been finalized and that an additional pensionable service period was added to your current pensionable service period in GEPF.

** Please take note that the additional pensionable service will be added on GEPF’s records as a period of bought service and the transaction may not be canceled once approved.

GEPF Benefits

The Government Employees Pension Fund (GEPF) is a defined benefit fund that manages pensions and related benefits on behalf of government employees in South Africa.

Established in 1996, it is the largest pension fund in South Africa and one of the largest pension funds in Africa and the world.

Its current benefit structure offers members:

** Withdrawal benefits;

** Retirement benefits;

** Ill-health or Disability benefits; and

** Death benefits.

The GEPF is governed by the Government Employees Pension (GEP) Law (1996). The executive authority of the GEPF is the Board of Trustees (“Board”).

FAQ On GEPF

Here are some frequently asked questions (FAQ) about GEPF (Government Employees Pension Fund):

Q: What is GEPF?

A: GEPF is a defined benefit pension fund that provides retirement, disability, and survivor benefits to government employees in South Africa.

Q: Who can join GEPF?

A: Membership to GEPF is mandatory for all employees in the public service who are appointed on a permanent basis. Members include government employees, teachers, police officers, and members of the judiciary, among others.

Q: How is GEPF funded?

A: GEPF is funded by contributions from employees and employers. Members contribute a fixed percentage of their pensionable earnings to the fund, while employers contribute a fixed percentage of their employees’ pensionable earnings.

Q: How is the pension benefit calculated?

A: The pension benefit is calculated based on the member’s years of pensionable service and their final salary. The final salary is the average of the member’s highest 12 consecutive months of pensionable earnings.