SARS Auto Assessment Status Online : South African Revenue Service

Organisation : SARS South African Revenue Service

Facility Name : Check Auto Assessment Status Online (Auto Assessment Lookup)

Country :South Africa

Website : https://www.sars.gov.za/individuals/i-need-help-with-my-tax/use-our-digital-channels/

| Want to comment on this post? Go to bottom of this page. |

|---|

How To Check SARS Auto Assessment Status Online?

To Check SARS Auto Assessment Status Online, Follow the below steps

Related / Similar Facility : SARS Diesel Food Manufacturer Registration

Steps:

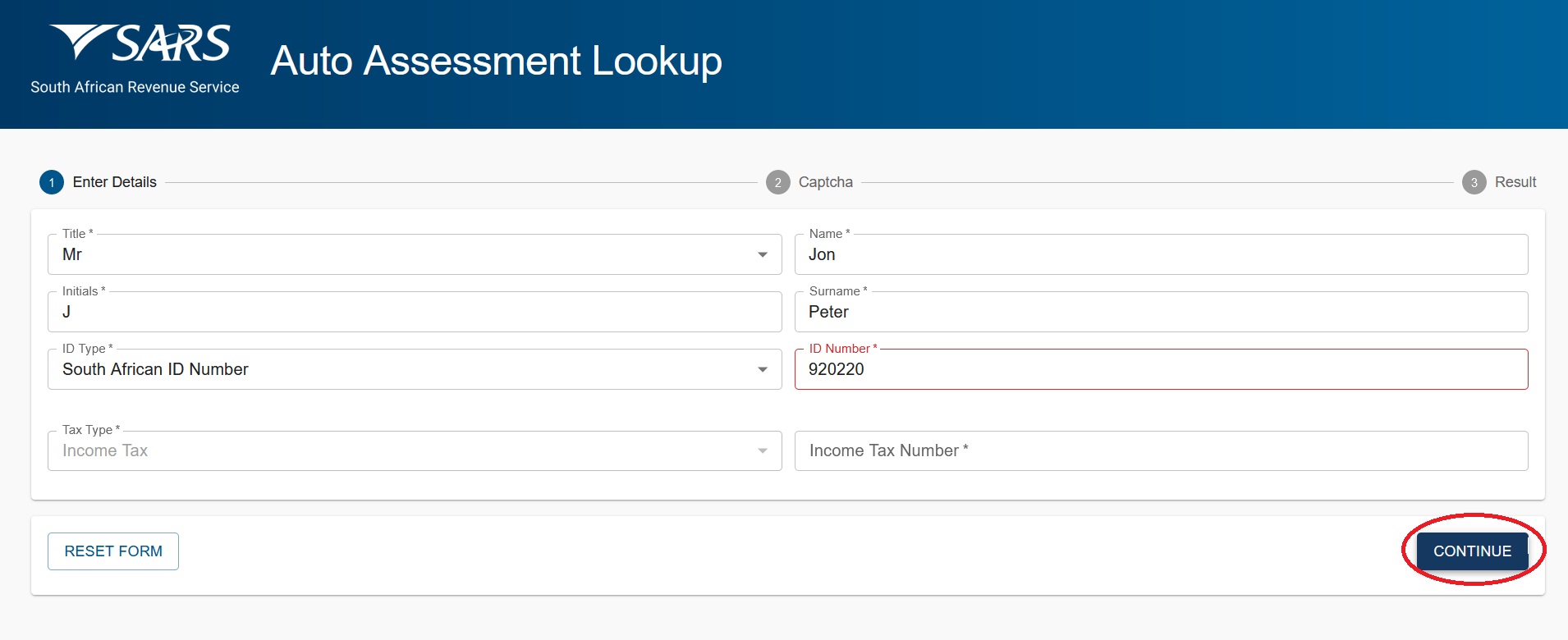

Step-1 : Go to the link https://tools.sars.gov.za/sarsonlinequery/assessmentlookup

Step-2 : Enter the Personal Details

Step-3 : Enter the Captcha and

Step-4 : Check Result Online

FAQ On SARS Auto Assessment

Frequently Asked Questions FAQ On SARS Auto Assessment

What is SARS Auto Assessment?

SARS Auto Assessment is a pre-populated tax return generated by the South African Revenue Service (SARS) based on the information they have on file for you. This information includes income from your employer, interest earned from banks, and medical expenses paid.

Who is eligible for SARS Auto Assessment?

SARS Auto Assessment is available to most individual taxpayers who meet the following criteria:

** You earned income from employment during the tax year.

** You received income from investments, such as interest or dividends.

** You have a South African identity number (ID number).

** You have a valid tax registration number (ITRN).

** You have not been selected for a compliance check.

How do I check my SARS Auto Assessment status?

You can check your SARS Auto Assessment status online using the SARS Online Query Service, eFiling, or the SARS MobiApp.

What should I do if I agree with my SARS Auto Assessment?

If you agree with your SARS Auto Assessment, you do not need to take any action. SARS will automatically process your return and send you a notice of assessment (NOA) if you are due a refund.

What should I do if I disagree with my SARS Auto Assessment?

If you disagree with your SARS Auto Assessment, you can file a tax return. You have until 23 October 2023 to file your tax return if you are not happy with your auto assessment.

SARS Mobile Tax Services

Taxpayers with no internet connectivity or smart phones can request certain tax services for free. USSD or quick codes as it is known, is a new feature available to taxpayers. Taxpayers who have basic standard mobile devices (not a smart phone or internet) can send an SMS or a USSD request to SARS. Taxpayers with smart phones and internet have access to more services including the SARS MobiApp, Live Chat and ‘Ask SARS a question’. For more detail on all mobile services available on both smart and basic phones, see the online Guide to SARS Mobile Tax Services. Or if you have any issues sending a USSD query to SARS, see the ‘Frequently Asked Questions’ section at the bottom of this webpage.